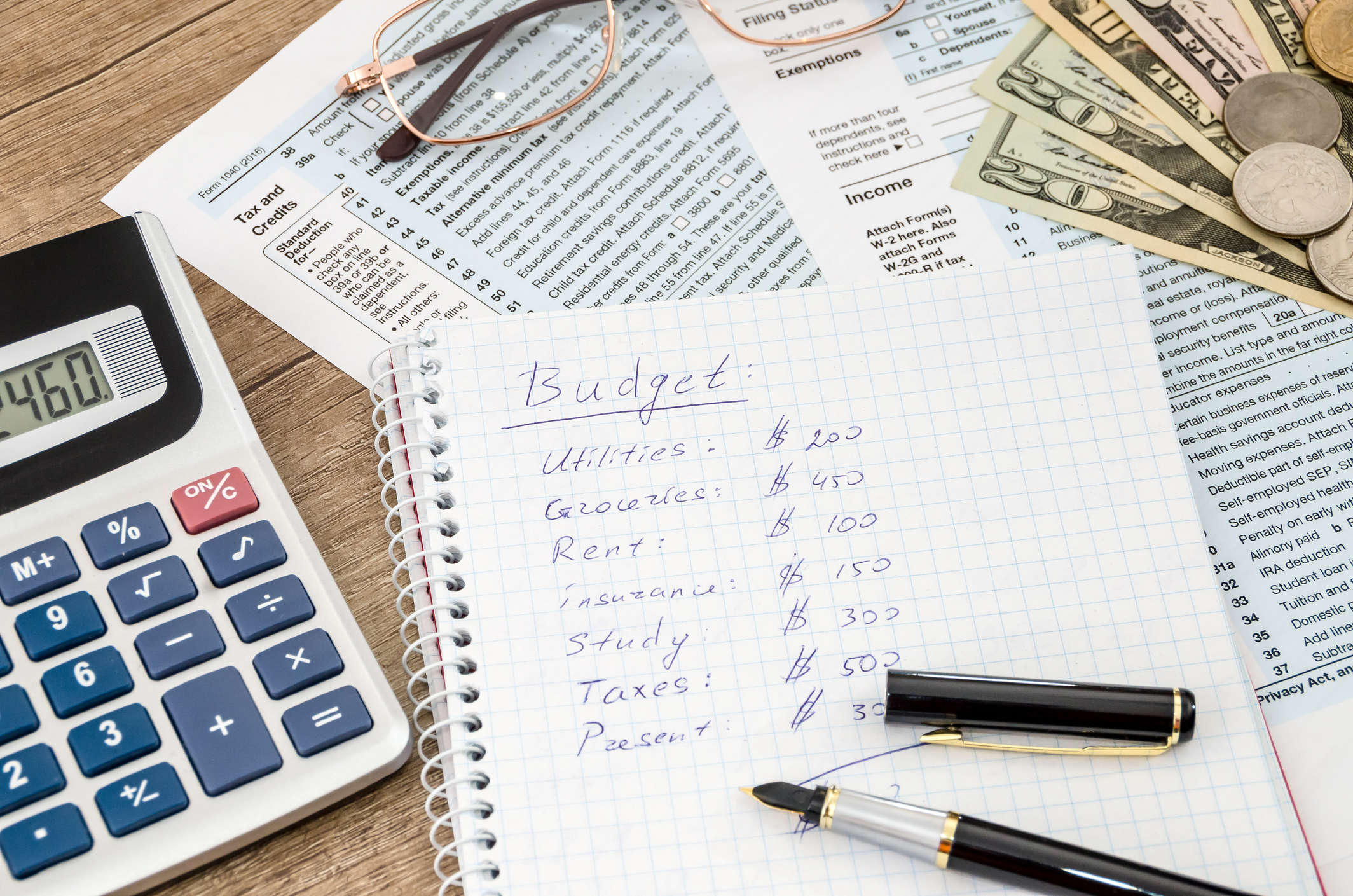

Money Resolution 1: Produce A Budget

For most of us, the beginning of a completely new year could be the hired time to get serious making firm resolutions for positive modifications in their lives. It is also customary for any couple of of those individuals to stop by themselves self-improvement promises when month two or three of year appears.

Often, why they don’t complete their New Year’s goals is that they did not outline just what they were required to complete to accomplish them. It’s not sensible to produce nice-sounding resolutions without thinking about the requisite steps to know them.

Inadequate persistence for effort required for change to occur is an additional obstacle to goal achievement. If you wish to reverse an undesired conduct, you need to be ready to do anything, despite discomfort or inconvenience, to think about new attitudes and actions.

Request your spending

Over these occasions, it is crucial that you need to have a very good idea of what the right path of existence costs you for the entire year. There are produced an exercise of planning your expenses, the first money objective for 2015 is always to create a budget to enable you to understand your approaching bills. Consult Columbus Financial & Success Coach Budgeting Expert to help you budget and meet your goals very smoothly

A detailed budget will reveal when you expect certain expenses that do not occur every month, much like your automobile insurance, children’s school charges or Christmas holiday costs. Then you’re able to work out how much to put aside every month to cover these bills after they come due.

Through an extensive budget might also offer you an opportunity to prioritise your financial obligations, and select which ones should be reduced or eliminated. Since prices is booming much more than most incomes, you might like to reduce some expenses so that you can settle the bills.

Create all of the expenses

Step one in creating your allowance is always to devote a few hrs to consider the right path of existence as well as the costs connected from it. Whether or not you are writing on paper or utilize a computer, undergo each month and think about all the approaching occasions and transactions which will need certainly spend cash.

Bear in mind the cash you will save is certainly a cost too, and don’t omit small-ticket products as they can eliminate all of your budget. To produce this process simpler, you’ll be able to search on the internet to download a low cost spreadsheet or application getting an in depth report on expenses.

When designing your list, include all the costs that has to certainly be compensated, even when you are not the one that will ft the total amount. For example, in situation your kid’s school charges are addressed by a relative who not reside in your family people, you have to still record it a line item owed to your allowance.

Determine realistic costs

Once you have completed your listing, afterward you need to consider simply how much the products will set you back for just about any day, week, month or year. If you don’t usually write lower your spending, you’ll most likely find this challenging, but you’ll be able to make realistic estimates relating to your expenses.

Examine old bills, or check out debit or bank card statement that may help you verify previous payments. You may even utilize a small notebook or possibly your smartphone to record when you spend cash. Following a few several days you need to have a far greater idea of numerous your loved ones costs.

If you are not aware in what you spend for products like gifts or clothing, make an effort to set a suitable spending limit for your year that is founded on the right path of existence. When you input all your other outlays, you’ll be able to determine if you are in a position to really have the ability to spend that volume of the income on these items.

Calculate average monthly costs

Next, exercise the normal cost of the expenses for starters month. So, in situation your automobile insurance policies are $3,600 for your year, you have to divide this cost by 12 to acquire a typical monthly cost of $300. This really is really the total amount you need to earn each month to cover this bill.

Accumulate the figures of the average monthly expenses, and you will identify the all-inclusive costs from the lifestyle monthly. Even if you not necessarily spend that sum each month, you need to earn that average amount, if you wish to pay back your debts without getting to become stressed or counting on loans.

Then, be aware famous your wages for instance salary, alimony, remittances or sketches from business. Every money source familiar with settle payments needs to be incorporated. Finally, remove your general expenses from your total earnings to discover for individuals who’ve the extra or shortfall of earnings.